Direct listing guide: Part 3 (Application and Post-Listing)

Part 3 summary

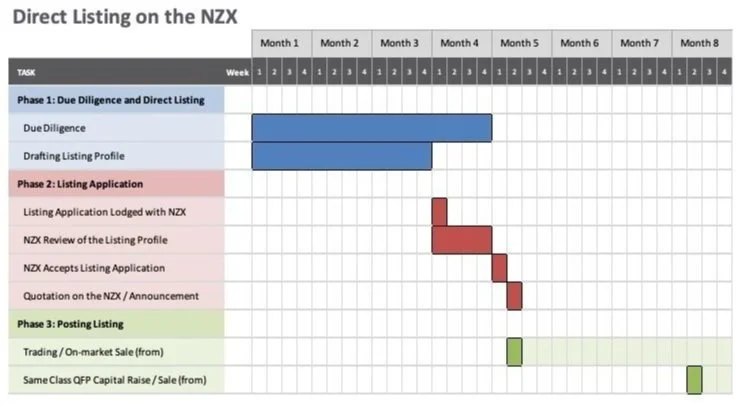

NZX assesses and tests a listing application. There will be reviews and revisions to the listing profile before NZX will grant its approval to the listing application. This process can take around 4 weeks.

On quotation, the reference share price will be set with advisor input but initial market trading can determine the trading share price.

After listing, new legal regimes will apply. These include the continuous disclosure regime, periodic financial reporting obligations and the listed entity corporate governance.

Companies are able to raise capital from retail investors relying on the “same class” exemption 3 months after the listing date.

Applying to be listed on the NZX

Once the listing planning is complete (see Part 2), the company must make a listing application to NZX. That application must include:

An application letter for quotation

The listing profile

A copy of the new constitution supported by a solicitor’s opinion

A copy of the company’s certificate of incorporation

Confirmation that a listing bond or deposit required by NZX has been provided or will be provided prior to listing

An executed pre-listing agreement and a listing agreement (or confirmation that one will be executed prior to listing)

The number and details of each class of securities on issue at the time of the application

Waiver applications (if applicable)

Contact details

Copies of the applicant’s annual reports for the last five years (if available)

All other documents or information as required by NZX from time to time.

After receiving a full application, NZX will appoint an internal team to manage and approve the listing application. This is not an automatic approval process. In general, there will be a couple of turns of reviews and revisions to the listing profile between the company and NZX for it to get to a final, approved form. This process generally takes around 4 weeks from the date of application.

It is important to engage NZX early in the due diligence and planning stage. NZX should be aware that the company is considering a listing, including a timeframe so that NZX can allocate their team/resources to review the listing application in a timely fashion. The company should also seek to obtain and address high-level issues and comments that NZX may have before making its application. This helps avoid any roadblocks at the formal application stage.

The Financial Markets Authority is not engaged in a direct listing. However, if the company was undertaking a traditional IPO, as a matter of prudence, the company should request FMA for a pre-registration review at the same time as making the listing application to the NZX. Similarly, it would be around this time that the company would negotiate a public capital raise insurance policy, as the standard D&O cover would exclude public capital raise activities.

When obtaining the listing approval from the NZX, the company should also undertake its own approval process for listing. This would include a final report from the DDC to the board, informing the board that the listing profile meets all the legal requirements. The DDC report should be supported by individual DDC members and other evidence, including an opinion from the legal advisor, to confirm that a proper due diligence process was undertaken. Armed with these and its own investigation, the board can approve the company’s listing.

With a direct listing, there is no public offer process. So once the listing application is approved, the company will then be quoted on the NZX Main Board.

The NZX listing fee is calculated on listing based on the initial market capitalisation. NZX will charge a base listing fee of $34,000 and a fee of 0.086663% of market capitalisation above a $20 million threshold. For companies that go above $50 million market capitalisation, different $ fees will be payable. A listing bond/deposit and annual listing fee are also payable after listing. For example, a company with a $45 million market capitalisation on listing will have an initial listing fee of $55,665.75 and a listing bond of $20,000 (before advisory and other fees, more on these in Part 2).

When shares start trading

On listing, the quoted shares will start trading on the NZX Main Board. The initial quotation price is set by the company with advisor input. This is different to a traditional IPO where the price is set with the input from the lead manager of the public offer and by the market demand for shares discovered during the offer process. So for a directly listed company, the self-determined price can only be tested on listing with trading.

Aside from selecting a sensible quotation price, another potential issue for directly listed companies is the illiquidity of their shares. If there is no market awareness of the listing, then this can mean not enough buyers on quotation. On the other hand, if there are not enough existing shareholders on listing, it can mean not enough sellers. These conditions can make a thin market.

You can address the pricing and liquidity issues by engaging an investment advisor for a sensible quotation price (based on market, competitor analysis, etc.), carrying out pre-listing capital raise to increase the shareholder spread and also carrying out PR activities to increase market awareness and demand prior to listing.

What happens after listing

A private company is generally free to do whatever it pleases, within the bounds of the law. Once listed, everything changes. Among other things:

The continuous disclosure regime applies. From listing, the company is required by law to disclose immediately to the market every piece of news that a reasonable person would expect, if it were generally available to the market, to have a material effect on the price of its shares. There are exceptions and subrules to how the disclosure regime applies, but it can be a difficult regime to grasp fully (and NZX has a guidance note on it).

Periodic financial and other reporting obligations apply. The company needs to report its financial results every half-year. An annual report needs to be published, including an independent audit and auditor’s statement. If the company is a sufficiently large listed entity, the new climate-related financial reporting regime will apply. Directors, senior managers and substantial products holders (generally anyone with 5% or more interest in the company’s quoted financial products) must also keep the market informed about their shareholdings.

The corporate governance regime applies. Companies need to implement the various corporate governance policies, charters and codes adopted as part of the listing. They also need to appoint new subcommittees of the board.

Another aspect of being listed on the NZX is that the company can raise capital from the public market (including retail investors). In particular, after 3 months of listing and continuous trading, a listed entity can rely on the “same class” exemption under clause 19 of Schedule 1 of the Financial Markets Conduct Act 2013. The same class exemption allows the listed entity to bypass the more burdensome process of preparing a product disclosure statement before it is able to raise capital from retail investors. This is a significant benefit for listed companies.

Final thoughts

A good listing is one where the board and majority shareholders have a clear understanding of what’s involved in the listing process - the pros and the cons and the alternatives. Listing has various benefits: Liquidity for shares, ability to raise future capital, and increasing the public profile, among others. However, the preparation for listing can be burdensome and the listing criteria - initial market capitalisation, shareholder spread, corporate governance requirements - must be met. In some cases, remaining a private company, or listing on alternative stock exchanges (including Catalist, which is specifically targeted for SMEs), might be preferable.

I hope this 3-part analysis has helped with explaining the listing process and demystified it a shade. It can be daunting, but also a very satisfying milestone for companies. Please get in touch with me if you have any questions or feedback.

Josh Woo is an NZX-approved solicitor for listing. If you have any questions or comments regarding this article or would like to discuss capital raising or exit options, please get in touch with Josh (e: josh.woo@jwlegal.co.nz | p: +642102938699).