NZ Guide for Aus Companies: Part 1 (Listing on NXZ)

A How-To Guide for Australian Companies - Listing on NZX as a Foreign Exempt Issuer

Overview

Australian companies increasingly look to New Zealand’s capital markets to broaden investor access and enhance visibility. The upcoming listing of Uvre Limited is case in point. NZX’s Foreign Exempt Issuer regime provides an efficient pathway for ASX-listed companies to dual-list without replicating full New Zealand compliance. An NZX listing can expand retail investor access, enhance company profile, diversify liquidity (with NZ funds and KiwiSaver schemes), and simplify future capital raisings under the Mutual Recognition regime (See Part 2). These benefits are weighed against modest NZX trading volumes, incremental administrative costs, and the need to coordinate disclosure timing across two markets.

The following guide explains how the regime works, what obligations apply, and how to prepare for a smooth NZX listing, combining practical steps with strategic insights.

For companies not already listed on the ASX, see our guide for direct listing.

1. The Foreign Exempt Issuer regime and application in brief

NZX Listing Rule 1.6 establishes the Foreign Exempt Issuer framework. An issuer must:

already be listed on a Recognised Stock Exchange (e.g. ASX, SGX, LSE);

remain listed and compliant with its Home Exchange rules for the same class of securities; and

maintain all quoted securities on both exchanges.

In return, the issuer is deemed to comply with most NZX Listing Rules so long as it stays in good standing on its Home Exchange. This “lite-touch” regime avoids duplicating continuous-disclosure and governance obligations already imposed overseas.

Some core NZX Listing Rules will apply directly. These include, for example:

Rule 1.22.2 (Appointment of Authorised Representatives);

Rule 1.23 (Payment of Fees);

Rule 3.26 (Announcement Format and Timing); and

Rule 3.29 (Confidential Correspondence with NZX).

The application process is governed by NZX Practice Note 33 (Applications for Foreign Exempt Listing from ASX Issuers)

One of the key steps involved is the preparation of a listing “Profile” document. For ASX-listed issuers, NZX only requires this profile to reflect existing ASX disclosures. This is a more simplified process and documentation requirement compared to a the standard NZX listing. The issuers also do not necessarily need to include prospective financial information. If an applicant elects to include PFI in the Profile, this information must comply with Australian accounting standards and the Listing Rules of the issuer’s Home Exchange.

NZX has made available template listing profile for foreign issuers for ease of application. See their documents page.

2. Continuous disclosure through MAP

Although NZX recognises home-exchange compliance, Foreign Exempt Issuers must still disclose market-moving information to NZX’s Market Announcement Platform (MAP).

Key principles:

All announcements released to the home exchange must be lodged with MAP at the same time, or promptly and without delay.

MAP announcements must appear on the issuer’s letterhead, dated, and attributed to an authorised representative.

Long or complex releases should begin with a short summary for New Zealand investors.

Announcements must clearly mark whether they contain Material Information.

If trading in the securities is halted or suspended on the home exchange, a corresponding halt or suspension will normally apply on NZX.

Issuers must also notify NZX promptly of:

any home-exchange breach, waiver or disciplinary action, and

any change affecting quotation (e.g. class reorganisation or delisting).

3. Strategic takeaways for boards and management

While the regime is largely procedural, directors should view a New Zealand listing as more than an administrative step.

Key strategic considerations:

Market engagement: Announce the NZ listing as part of a broader investor-relations strategy, not just compliance.

Liquidity expectations: Dual-listing rarely doubles trading volumes; focus instead on retail access and index inclusion.

Governance perception: NZ investors expect transparency and fair dealing consistent with local norms even when formal obligations differ.

New capital: Raising new capital across both markets become easier with the Trans-Tasman Mutual Recognition regime as well as under the Financial Markets Conduct (Same Class Offers ASX/NZX-Quoted Financial Products) Exemption Notice 2023.

Exit or transition planning: If the issuer later seeks a full NZX listing or de-listing, early discussion with NZX helps to manage timing and disclosure continuity.

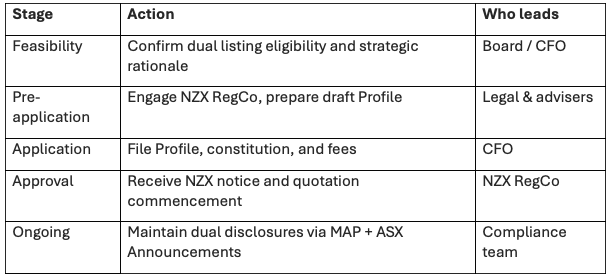

4. A Practical Roadmap

Key Takeaways

Eligibility is conditional on ASX compliance – Stay fully listed and current on ASX.

MAP disclosure is essential – Timeliness and format matter.

Engage early with NZX RegCo – Early dialogue smooths approval.

No double reporting – But fair-dealing and advertising rules still apply.

Think strategically – Use NZ listing to strengthen investor access and credibility.

JW Legal Limited advises Australian and New Zealand issuers on cross-border listings, securities offers, and financial-markets regulation. For guidance on NZX Foreign Exempt Issuer applications or trans-Tasman offer structures, contact our Corporate & Capital Markets team.